Oil companies can keep on organizing contingency plans to maintain a healthy, safe supply-and-demand balance, however there are so many influences that affected the dramatic decrease. The politics, as well as the new technologies of oil production, make it less clear on how to effectively address the issue with a plan that will sustain long term results.

Low oil prices are taking a major toll in the industry. Firms in the oil and gas drilling services are facing numerous threats. One company even reported that they might have to cut more than 6,000 jobs because of decreasing stock values, yet debt management doesn’t seem to be an issue. According to The Street, stockpile steadily increases, but the company’s low debt-to-equity ratio is still higher than the industry average. Also, its quick ratio is quite high, demonstrating its strong liquidity, and possibly revealing its ability to bounce back from further impending debts.

Yet while some companies are cutting down on jobs, others are creating new opportunities. Operations continue to grow for UnaOil, a firm that supplies a diverse range of services to the energy sector in Africa, Central Asia, and in the Middles East. In support of expanding operations in Iraq, the company recently opened a strategic base in North Rumalia. The facility, extending to 62,000 square meters, will strengthen business contracts between this company and international corporations, and local Iraqi companies.The base will accommodate a diverse staff, and have have a full range of facilities “an array of workshops for technical services, valve repair and maintenance, and rotating equipment service support,” as reported by TradeArabia News Service.

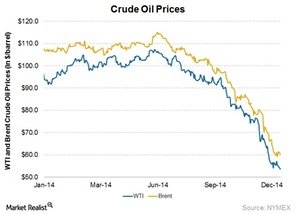

Experts explain that the introduction of new bases and reserves won’t have an immediate effect to the falling oil prices. The rate of the decline is drastic, and recovery of lost revenue will take much longer than the seven months of deteriorating values. Had the price fall been at a steadier pace, it would have given more time for development for a new project, becoming fully operational to respond to the price drop. While new reserves won’t yield immediate results, there’s some hope that the rate of the decline will become more gradual.