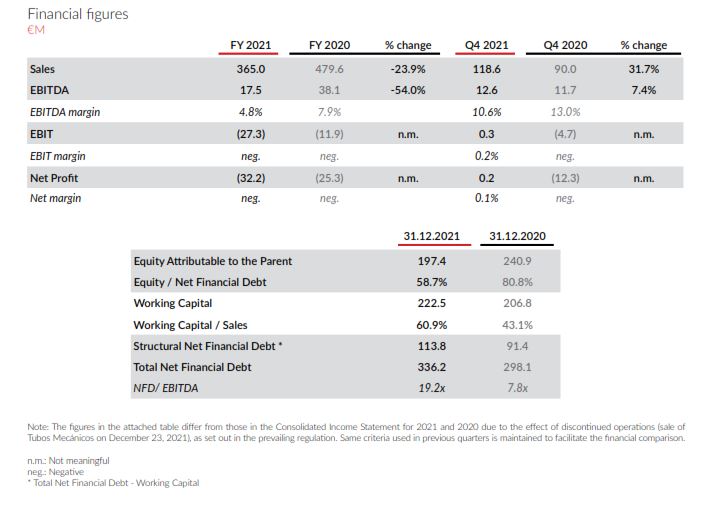

- The results for the fourth quarter return to positive net profit, with sales of €118.6 M and an EBITDA of €12.6 M, representing a margin of 10.6%.

- But for the effect of inflation on energy costs and on the value chain in general, the figures for the last quarter would have been even higher.

- This better performance of the business in the second half of the year confirms a change in tendency that will be maintained over the coming years.

- The increased competitiveness, the solid backlog and a booming energy market situation enables us to face 2022 with optimism.

- Sales for 2021 stood at €365 M, down 23.9% on the previous year and down almost 50% on pre-COVID-19 years. The EBITDA stood at €17.5 M, with a margin of 4.8%.

- The results for the year have been affected mainly by the low order intake and cancellations during the pandemic.

- Despite high inflation, especially in energy costs, the price increases that are already being implemented will allow to mitigate this effect, so results for 2022 should be higher than those achieved in 2018 and 2019.

- TUBACEX has liquidity in excess of €170 M, which guarantees the soundness of the Balance Sheet and covers the maturity of loans until 2024.

TUBACEX has presented its results for 2021 today, bringing to an end two years marked by the effects of the pandemic on the business. The results for the fourth quarter return to positive net profit, with sales of €118.6 M and an EBITDA of €12.6 M, representing a margin of 10.6%, in spite of being significantly affected by inflation in energy costs and in the value chain in general. “The cost reductions implemented within the framework of our global restructuring plan, the solid backlog and the fact that we are in a booming energy market, enable us to face 2022 with optimism”, declared Jesús Esmorís, CEO of TUBACEX.

The results for the past two years have been marked by the impact of COVID-19 on the order intake and the lengthy cost adjustment process at the plants in Alava. In this context, the Company presented sales amounting to €365 M for 2021, down 23.9% on the previous year and down almost 50% on pre-pandemic years. The EBITDA stood at €17.5 M, with a margin of 4.8%. However, better performance of the business in the third and fourth quarter of the year confirms a change in tendency that will be maintained over the coming years.

The effect of high inflation, particularly the increase in energy costs, will continue to be appreciated during the coming quarter in the backlog already sold. “However, the price rises that we are implementing will enable this effect to be reduced as of the second quarter and the results for 2022 should be higher than those achieved in 2018 and 2019”, pointed out Esmorís.

The net financial debt figure stands at €336.2 M, at levels that are temporarily very high. In spite of this, the successful financial restructuring plan implemented by TUBACEX in 2020, has enabled the Group to maintain liquidity in excess of €170 M, which guarantees the soundness of the Balance Sheet and covers the maturity of loans until 2024. Furthermore, growth expectations over the coming months and the gradual improvement in results will enable the net financial debt figure to be reduced, returning to pre-COVID debt ratios by the middle of 2022.

A reinforced organization

During 2021, TUBACEX has been strengthened in order to face the market change as a result of the energy transition. On one hand, the company has completed a global restructuring plan, achieving savings in excess of €30 M at a consolidated level, increasing the Group’s competitiveness. On the other hand, it has continued to boost its sales positioning, as a supplier of advanced solutions, enabling it to move closer to end users and sign more than 20 long-term framework agreements.

As for its geographical growth, it is worth highlighting the organization’s consolidation in the American market, where it added new production capacity in 2020 through the new Tubacex Durant factory (Oklahoma) and the acquisition of Amega West (with facilities also in Canada and Singapore), both of which focus on the precision industry. With them, TUBACEX has five plants in America. As for Europe, the development of the new TSS Norway subsidiary and long-term contracts with manufacturers of umbilicals stand out. In Asia, the Group has increased its direct presence in Kazakhstan with a new plant in the city of Atyrau, having significantly increased its business volume in the area.

Market recovery

Following on from a 2020 marked by the cancellation of orders and a very low order intake, 2021 has seen a continuous and gradual increase in orders, enabling it to close the year with a backlog of over €500 M in high value-added products.

This market improvement is particularly evident in the Gas and Nuclear sectors, transition energies in which TUBACEX is strongly positioned.

Therefore, quotes for orders of high corrosion resistant OCTG tubes for oil and gas extraction and production, have clearly increased throughout the year and many projects are still in the final award phases. As for umbilical tubes to transport fluids, energy and signal transmission to subsea facilities, TUBACEX has closed 2021 with a record figure in order intake. The acquisition of TSS Norway at the end of 2020 has enabled the Group’s presence to be increased in one of the regions that concentrates the highest investment volume in this segment. Regarding the nuclear segment, TUBACEX has received major orders in 2021 thanks to its long-standing positioning in this growth sector.

In addition to its traditional business, focusing on high value-added solutions and profitability, TUBACEX remains focused on the low emission energies segment with the development of innovative solutions that support customers’ decarbonization processes, or entry into developing markets, such as hydrogen or carbon capture and storage.