The Covid-19 pandemic has demolished global oil demand and as producing countries continue to quarrel over output cuts, stocks are building by the day. At current filling rates, a third of available crude storage capacity in the US will already be filled in April, a Rystad Energy analysis shows. With additional oil coming, the largest production shut-ins in the country’s history are not far off.

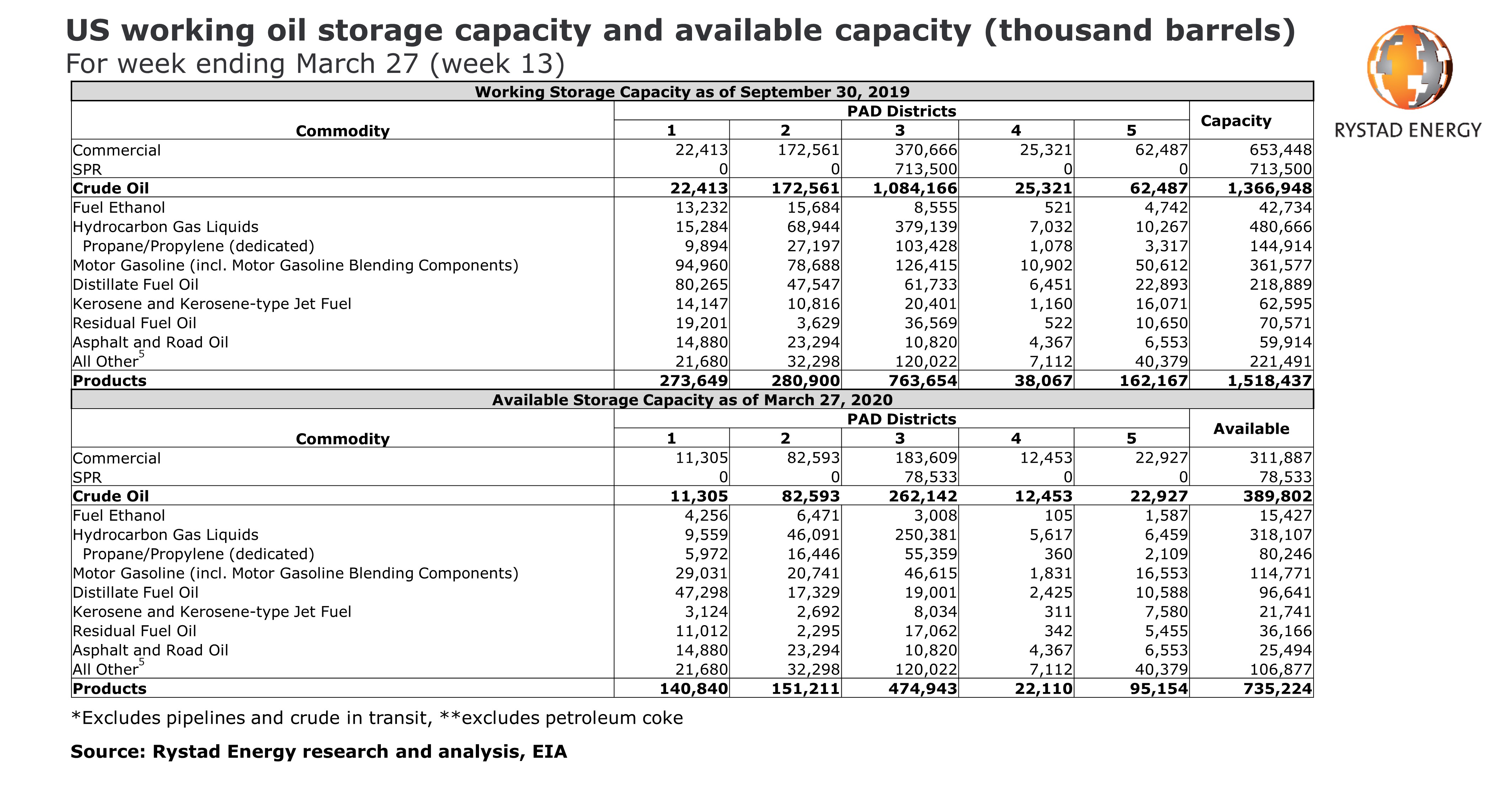

Rystad Energy’s analysis shows that total commercial storage in the US stands at about 653.4 million barrels, or some 780 million barrels including pipeline fills and crude-in-transit. At the end of March, 469.2 million barrels of oil were already in stock.

Non-commercial storage, known as strategic petroleum reserves (SPRs), has the capacity to store 713.5 million barrels of crude and is already almost full, as it already contains 634.9 million barrels of crude. This implies remaining spare capacity of 389.8 million barrels or 29%, 311.8 million barrels of which is available for commercial stocks and 78.5 million barrels of which is available for SPRs.

“We currently estimate that commercial crude stocks might build by nearly 90 million barrels in April 2020 as refiners dramatically reduce runs and producers bring about 12.7 million bpd of supply,” says Rystad Energy’s senior oil market analyst Paola Rodriguez-Masiu.

Stay up to date and get immediate email notification when we publish COVID-19 related reports and press releases. Sign up here

Crude builds in April will reduce available crude capacity by a third, leaving, in theory, about 200 million barrels of storage capacity (or two more months at the same filling rate). In practice, available crude capacity might be closer to 150 million barrels.

In addition, storage is not equally available to all market participants; producers might struggle to access this capacity as most is located far from production sides, only reachable via pipelines. Pipeline operators are already restraining access to their systems because there is no buyer at the end-side. Also, a percentage of the available capacity is already locked in long-term lease agreements.

Learn more in Rystad Energy’s OilMarketCube.

“Many market participants suggest that offshore crude storage will help fill the gap – the Port of Corpus Christi recently stated that the port can support floating storage. However, we find that floating storage capacity is limited and cannot help resolve what ultimately happens onshore,“ adds Rodriguez-Masiu.

At the heart of the storage problem is the sudden drop in road fuels demand. With several states across the US mandating non-essential workers stay at home in order to halt the spread of the coronavirus outbreak, including states with the highest road fuel demand such as California and New York, we estimate that US gasoline demand is set to decline by an unprecedented 3.3 million bpd y/y in April 2020.

The astonishing gasoline demand collapse will push refiners to cut runs and, in some cases, will trigger shut-downs altogether. We currently estimate that US refinery runs in April will fall by 3.8 million bpd y/y to 12.6 million bpd. The Gulf Coast accounts for 1.5 million bpd of the reduction and the West Coast for nearly 900,000 bpd.

For more analysis, insights and reports, clients and non-clients can apply for access to Rystad Energy’s Free Solutions and get a taste of our data and analytics universe.